State Conformity to Section 174

One of the significant tax law changes with the One Big Beautiful Bill (OBBB), signed into law on July 4, 2025, relates to the timing of tax deductions for research and experimental expenses under IRC section 174. This blog post summarizes the federal tax treatment of R&E expenses and the state conformity thereto.

One of the significant tax law changes with the One Big Beautiful Bill (OBBB), signed into law on July 4, 2025, relates to the timing of tax deductions for research and experimental expenses under IRC section 174. The below summarizes the federal tax deduction for R&E expenses and the state conformity thereto.

Federal Treatment

Before TCJA: Section 174 allowed R&E expenses to either be immediately deductible in the year incurred or — at the taxpayer’s election — capitalized and amortized over a period of not less than 5 years.

Under TCJA: Section 174 was amended to disallow full expensing of R&E expenses starting in 2022. Instead, R&E expenses were required to be capitalized and amortized over a 5-year period (for domestic R&E expenses) or a 15-year period (for foreign R&E expenses).

OBBB changes

Prospective changes: OBBB restores the immediate deduction for domestic R&E expenses incurred in 2025 and future years. In lieu of immediate expensing, taxpayers can elect to amortize domestic R&E expenses over a 5-year period, or ratably over a 10-year period for certain section 174(a) expenses. The requirement to amortize foreign R&D expenses over 15 years remains unchanged.

Retroactive changes: OBBB permits small businesses (under $31M average annual gross receipts for the three preceding tax years beginning in 2025) to retroactively deduct capitalized R&E expenses for 2022 - 2024. Small businesses may either amend their prior year tax returns for 2022 - 2024 or recover the unamortized R&E expenses on their current year tax returns for 2025 - 2026 (over one or two years at the election of the taxpayer). Larger businesses may deduct the unamortized domestic R&E expenses incurred in 2022 - 2024 over two years (2025 and 2026).

State Conformity

IRC conformity in general: States with rolling conformity to the current IRC or static conformity to the IRC after the enactment of the TCJA have incorporated the pre-OBBB federal treatment, including 5-year amortization for domestic and 15-year amortization for foreign R&E expenses, except for the states that have specifically decoupled from section 174. Generally, the rolling conformity states would automatically adopt the OBBB changes to section 174 and the new section 174A, while the static and selective conformity states would need deliberate legislative action to adopt the OBBB changes to these sections into state law.

Decoupling states: The states that have previously decoupled from section 174 include the following:

Rolling conformity states: Alabama, New Jesey (with respect to New Jersey qualified R&E expenses only), and Tennessee.

Static conformity states: Georgia, Indiana, Texas, and Wisconsin.

Selective conformity states: California, Mississippi, and Pennsylvania (for pass-through entities and individuals only).

Note that the decoupling from section 174 in New Jersey applies to qualified R&E expenses incurred in New Jersey only. In Pennsylvania, the decoupling from section 174 applies for pass-through entities and individuals only (not for corporations).

In the decoupling states, taxpayers can generally expense both domestic and foreign R&E expenses immediately or elect to amortize them over a period of not less than 5 years.

Constitutional Challanges

While the federal government is free to treat foreign commerce differently from domestic commerce, states and localities are generally precluded from doing so under the foreign commerce clause of the U.S. Constitution. Various state courts have found that conformity to the IRC cannot shield a state from constitutional scrutiny.

Taxpayers should consider the possibility of treating foreign R&E expenses similarly to domestic R&E expenses in the states that conform to the disparate federal treatment of domestic and foreign R&E expenses.

Recommended Next Steps

Look out for additional guidance from the IRS and the state tax authorities regarding the application of the amended IRC sections 174 and the new section 174A following the OBBB enactment. Feel free to reach out to your preferred tax advisor if you require further information or assistance.

State Tax Implications of CLOs

In a Tax Notes State article, which was published on July 24, 2025, I examine the state tax implications for U.S. investors in collateralized loan obligations (CLOs).

In a Tax Notes State article, which was published on July 24, 2025, I examine the state tax implications for U.S. investors in collateralized loan obligations (CLOs).

State Conformity to Section 163j

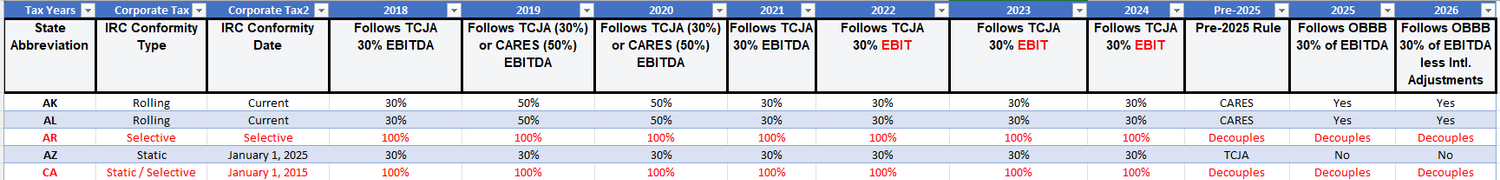

At Credit Fund Advisors, we have leveraged our expertise to develop a 50-state matrix on the state conformity to the IRC section 163j. The matrix covers tax years 2018 through 2026, including the OBBB amendments to section 163j in effect for 2025, 2026, and future tax years.

At Credit Fund Advisors, we have leveraged our expertise to develop a 50-state matrix on the state conformity to the IRC section 163j. The matrix covers tax years 2018 through 2026, including the OBBB amendments to section 163j in effect for 2025, 2026, and future tax years. The below sample shows the first five states in alphabetical order included in the matrix.

Please contact us at info@creditfundadvisors.com to request a copy of the matrix or need assistance with navigating the IRC section 163j state conformity issues.

Navigating State Conformity in the Wake of OBBB

Navigating state tax conformity in the wake of OBBB is top of mind for many organizations. In this blog post, we explore state conformity to the Internal Revenue Code, the state legislative process and timeline, and how taxpayers could navigate the state tax complexities.

Imagine a single bill that reshapes the U.S. federal tax landscape and trickles down to the states. The One Big Beautiful Bill (OBBB) has done just that, altering federal tax provisions in ways that demand the state legislatures' attention. In this blog post, we explore state conformity to the Internal Revenue Code, the state legislative process and timeline, and how taxpayers could navigate the state tax complexities.

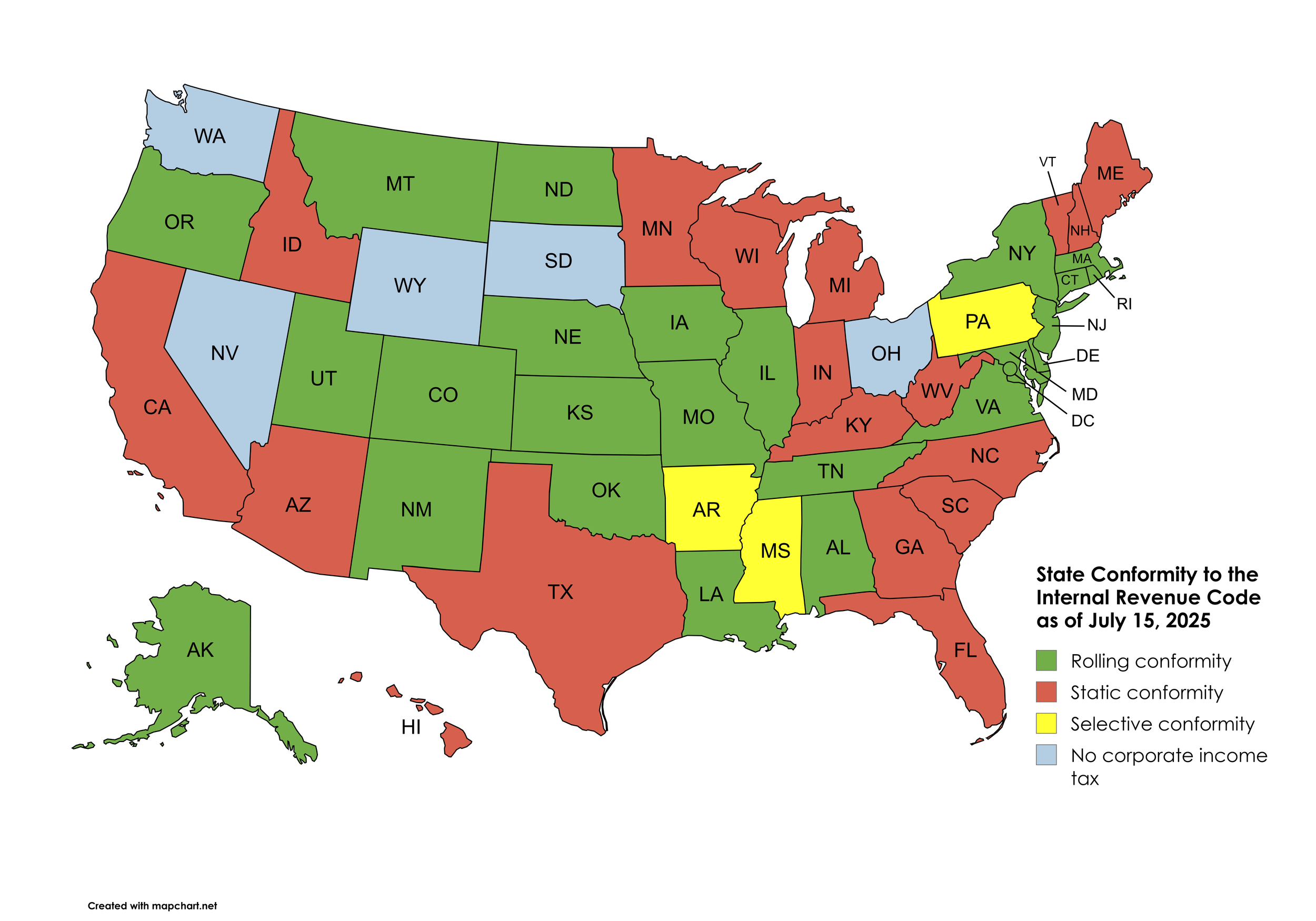

Generally, there are three types of state conformity to the IRC: rolling, static, and selective. The rolling conformity states automatically adopt the latest changes to the IRC without any action required by the legislature. Decoupling from the OBBB’s provisions would require deliberate legislative action in these states. The static conformity states conform to the IRC as of a fixed date that predates the OBBB’s enactment. Changing the fixed conformity date to adopt the OBBB’s provisions would require deliberate legislative action in these states. The selective conformity states adopt selected provisions only of the IRC.

The below map shows how each state conforms to the IRC as of July 15, 2025. Note that California is both a static and a selective conformity state because it selectively conforms to the IRC of 2015.

At present, the 2025 - 2026 fiscal year has already begun in most states. 46 states begun their fiscal year on July 1. New York began theirs on April 1, Texas will begin on September 1, and Alabama and Michigan will begin on October 1. Most states have enacted their fiscal year budgets, except for the District of Columbia, North Carolina, and Pennsylvania in which the state budgets were delayed. Michigan's budget is pending, but the state's fiscal year does not start until October 1.

Taxpayers may not receive any guidance from the states regarding their alignment with the OBBB until their next legislative session. About 80% of state legislatures have adjourned for the year. While several states remain in session all year, taxpayers should expect most states to address OBBB conformity or decoupling in the 2026 - 2027 legislative session starting in the late spring or early summer of next year. While possible, it is not generally anticipated that states will call special sessions to address OBBB alignment.

Because state alignment with OBBB impacts their tax liabilities, taxpayers should stay informed of the latest state tax developments and engage in proactive tax planning and modeling. Taxpayers should consider consulting tax professionals and let expertise guide them through the sweeping legislative changes. Credit Funds Advisors’ dedicated team is ready to assist. Get in touch with us to discuss how we can help you navigate through tax complexity.

California Adopts Single-Sales Factor Apportionment Formula for Financial Institutions

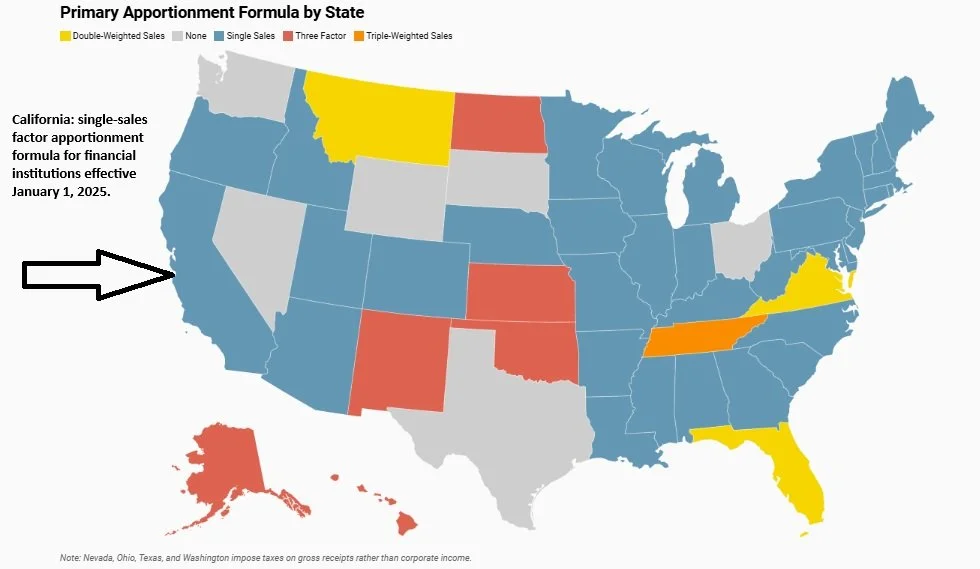

California Senate Bill 132 (S.B. 132), a taxation trailer bill that was attached to the state’s Budget Act of 2025 (S.B. 101), was signed by Governor Newsom on June 27, 2025, and enacted a single-sales factor apportionment formula for banks and financial institutions effective for tax years beginning on or after January 1, 2025. Direct lending funds that perform loan origination activities outside of California and have been filing as financial institutions in the state may see their 2025 California apportionment and tax liability double as a result of this change.

California Senate Bill 132 (S.B. 132), a taxation trailer bill that was attached to the state’s Budget Act of 2025 (S.B. 101), was signed by Governor Newsom on June 27, 2025, and enacted a single-sales factor apportionment formula for banks and financial institutions effective for tax years beginning on or after January 1, 2025. Direct lending funds that perform loan origination activities outside of California and have been filing as financial institutions in the state may see their 2025 California apportionment and tax liability double as a result of this change.

Under prior law, financial institutions used a three-factor apportionment formula comprised of receipts, property (including loans), and payroll factors with equal weighting to apportion their net income to California. For the property factor, loans were sourced under Cal. Code Regs. section 25137-4.2(d) to the location with which the loans have a ‘preponderance of substantive contact.’ This term means either the regular place of the taxpayer’s business to which the loans are assigned or the location where the taxpayer performed the preponderance (greater than 50 percent) of the loan origination for each loan.

Under the new law, financial institutions are required to use a single-sales factor apportionment formula effective beginning for the 2025 tax year. The property and payroll factors are no longer used to compute the financial institution’s apportionment to California.

If we assume Direct Lending Fund (DLF) which: (i) qualifies as a financial institution under state law, (ii) has 12% of its receipts in California, (iii) has 0% of its loans in California because it has a regular place of business and performs more than 50% of the origination activities for each loan outside of the state, and (iv) does not employ any people (that is, does not have a payroll factor), DLF would have had 6% apportionment to California, which is the average of 12% sales and 0% property, under the prior law. In contrast, under the new law DLF will have 12% apportionment to California which equals its sales factor.

Another legislative change that was enacted by the passage of S.B. 132 was the extension of California’s elective pass-through entity tax (PTET) for tax years beginning on or after January 1, 2026, and before January 1, 2031, subject to the application of the federal SALT cap under Internal Revenue Code section 164(b)(6) in those years. In other words, if the federal SALT cap is repealed, the California elective PTET will become inoperative as of January 1st of the following year.

The proposal to repeal the California water’s edge election, which Assembly Member Alex Lee (D) floated in a June 5, 2025, statement to Tax Notes, and which would have required taxpayers with nexus in California to compute state tax on a worldwide basis, has not been passed into law as part of the state’s budget for the 2025-2026 fiscal year which started on July 1, 2025.

Connect for Tailored Solutions — Credit Fund Advisors LLC to discuss your direct lending fund’s structure and California tax mitigation strategies.

State Tax Structuring Opportunities for NAV Lenders

In this article, which was published by Tax Notes on June 4, 2025, I explore state tax structuring opportunities for net asset value lenders (NAV) lenders to increase their yield. I provide examples illustrating how the terms of the loan and collateral agreements, collateral type, lender and borrower structure, and location where the loan origination activities are performed affect the jurisdictions where the interest is sourced and taxed.

In this article, which was published by Tax Notes on June 4, 2025, I explore state tax structuring opportunities for net asset value lenders (NAV) lenders to increase their yield. I provide examples illustrating how the terms of the loan and collateral agreements, collateral type, lender and borrower structure, and location where the loan origination activities are performed affect the jurisdictions where the interest is sourced and taxed.

Read more: https://www.creditfundadvisors.com/s/grains_of_salt_for_net_asset_value_lenders_20250604-173908.pdf