State Conformity to Section 163j

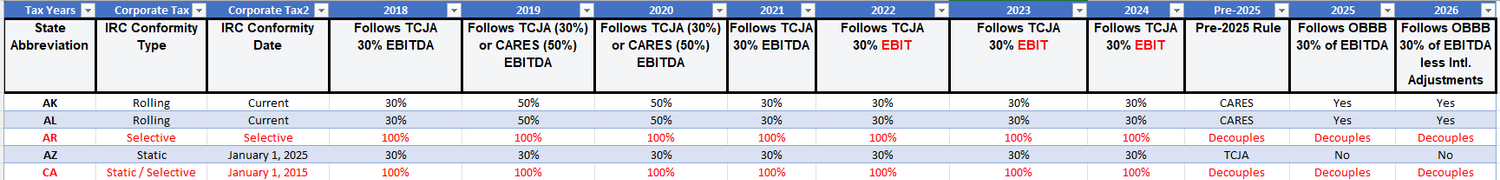

At Credit Fund Advisors, we have leveraged our expertise to develop a 50-state matrix on the state conformity to the IRC section 163j. The matrix covers tax years 2018 through 2026, including the OBBB amendments to section 163j in effect for 2025, 2026, and future tax years. The below sample shows the first five states in alphabetical order included in the matrix.

Please contact us at info@creditfundadvisors.com to request a copy of the matrix or need assistance with navigating the IRC section 163j state conformity issues.