Navigating State Conformity in the Wake of OBBB

Imagine a single bill that reshapes the U.S. federal tax landscape and trickles down to the states. The One Big Beautiful Bill (OBBB) has done just that, altering federal tax provisions in ways that demand the state legislatures' attention. In this blog post, we explore state conformity to the Internal Revenue Code, the state legislative process and timeline, and how taxpayers could navigate the state tax complexities.

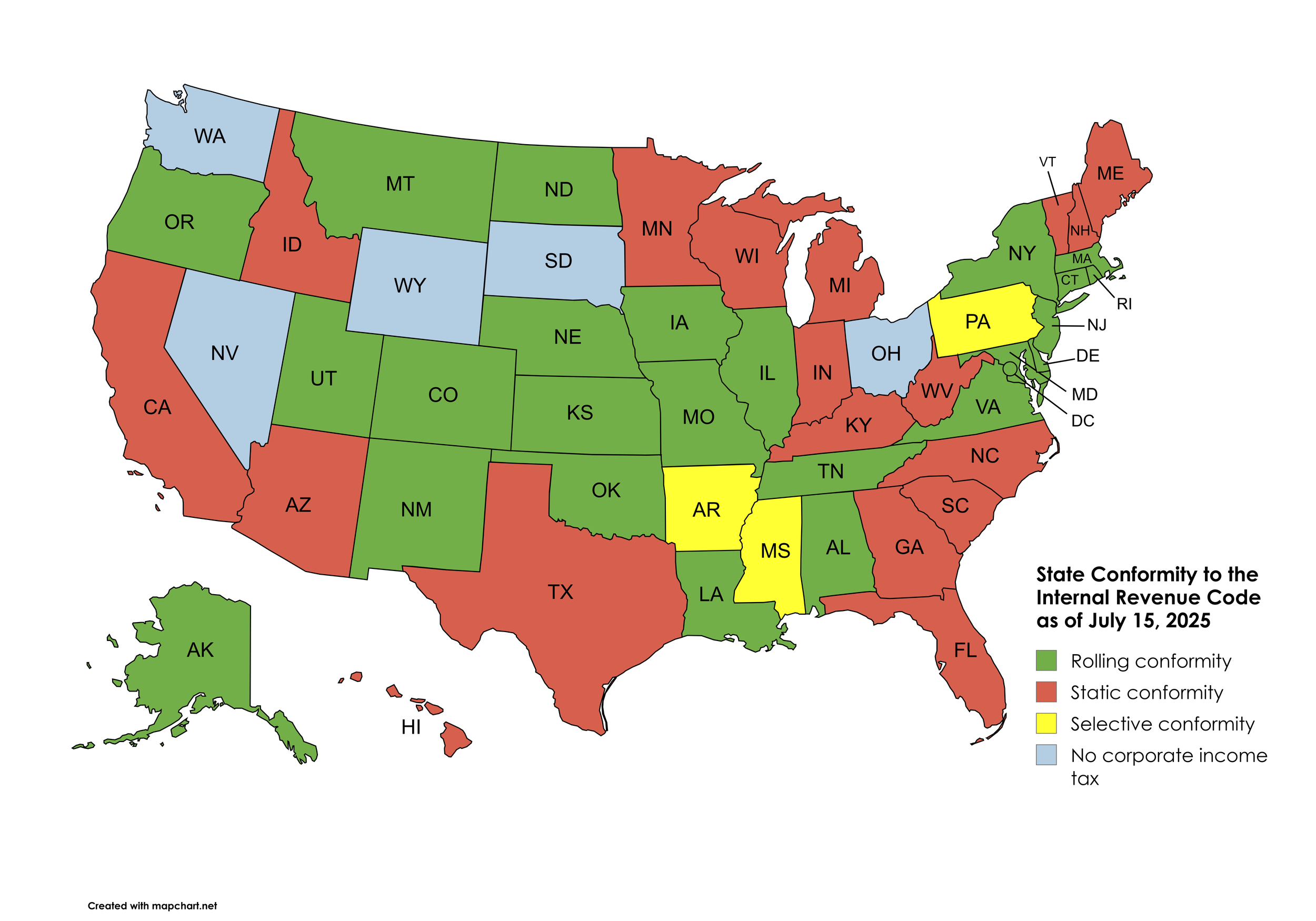

Generally, there are three types of state conformity to the IRC: rolling, static, and selective. The rolling conformity states automatically adopt the latest changes to the IRC without any action required by the legislature. Decoupling from the OBBB’s provisions would require deliberate legislative action in these states. The static conformity states conform to the IRC as of a fixed date that predates the OBBB’s enactment. Changing the fixed conformity date to adopt the OBBB’s provisions would require deliberate legislative action in these states. The selective conformity states adopt selected provisions only of the IRC.

The below map shows how each state conforms to the IRC as of July 15, 2025. Note that California is both a static and a selective conformity state because it selectively conforms to the IRC of 2015.

At present, the 2025 - 2026 fiscal year has already begun in most states. 46 states begun their fiscal year on July 1. New York began theirs on April 1, Texas will begin on September 1, and Alabama and Michigan will begin on October 1. Most states have enacted their fiscal year budgets, except for the District of Columbia, North Carolina, and Pennsylvania in which the state budgets were delayed. Michigan's budget is pending, but the state's fiscal year does not start until October 1.

Taxpayers may not receive any guidance from the states regarding their alignment with the OBBB until their next legislative session. About 80% of state legislatures have adjourned for the year. While several states remain in session all year, taxpayers should expect most states to address OBBB conformity or decoupling in the 2026 - 2027 legislative session starting in the late spring or early summer of next year. While possible, it is not generally anticipated that states will call special sessions to address OBBB alignment.

Because state alignment with OBBB impacts their tax liabilities, taxpayers should stay informed of the latest state tax developments and engage in proactive tax planning and modeling. Taxpayers should consider consulting tax professionals and let expertise guide them through the sweeping legislative changes. Credit Funds Advisors’ dedicated team is ready to assist. Get in touch with us to discuss how we can help you navigate through tax complexity.